Warm compliments of the festive season to all my fellow Nairalanders, wishing you joy and happiness during this special time of the year.

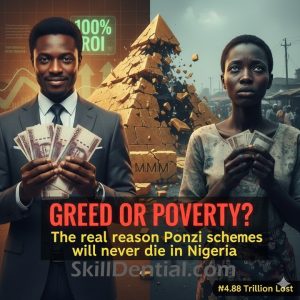

I was recently looking at some eye-opening statistics that truly shocked me. Did you know that between the years 2016 and 2025, Nigerians have collectively lost more than ₦4.88 Trillion to various Ponzi schemes? This staggering amount highlights the severe impact these fraudulent schemes have had on individuals and the economy over nearly a decade.

From the legendary MMM scandal that shook the financial world back in 2016 to the recent devastating CBEX crash that swallowed over ₦1.3 Trillion just this year alone, the cycle of financial fraud and deception never seems to come to an end. Every single time one scheme “crashes” and collapses, another one quickly emerges under a new name—often cleverly disguising itself using trendy buzzwords like AI, Crypto, or E-commerce as a form of “packaging” designed to mislead and deceive unsuspecting people.

The Big Debate: Greed or Poverty?

Whenever a particular scheme crashes and falls apart, causing significant distress and leading people to start “crying blood” metaphorically due to the severe consequences, the comment section inevitably becomes divided into two distinct groups:

The “Poverty/Sapa” Defense

The current economic situation is extremely challenging for many people. Inflation has surged past 30%, and the Naira is rapidly losing value against the Dollar, almost as if it is swimming backwards. This harsh reality has left countless individuals and families in a state of desperation.

When a scheme like Loom comes along promising to transform just ₦10,000 into ₦80,000 within a matter of days, it can appear to be the only possible way out for someone struggling to feed their family. Scammers are fully aware of this vulnerability and deliberately present themselves as “community helpers,” exploiting the desperation of people who are barely surviving.

The “Greed” Reality

On the other hand, how can anyone reasonably explain a “business” that boldly promises an astounding 100% ROI in just 30 days? To put this into perspective, even the world’s most powerful and established banks cannot guarantee a 30% return over the course of an entire year.

Interestingly, some of the people who fall for these schemes are not those struggling financially—they are often well-to-do individuals such as doctors, bankers, and other professionals who simply desire “fast money” without putting in the usual hard work. They fully understand that it’s a high-risk gamble, yet they hold onto the hope that they can “cash out” early and leave the unfortunate “lastcomers” to bear the financial losses and carry the burden.

The “Red Flags” We Keep Ignoring

Unrealistic Returns: Any investment opportunity that promises to double your money within just a single month should be treated as a major red flag and approached with extreme caution. Such claims are often too good to be true and can be a sign of potential scams or fraudulent schemes designed to take advantage of unsuspecting investors.

The “Bring Two People” Model: When the income is generated solely from recruiting new members, rather than from selling actual products or services, it functions as a pyramid scheme rather than a legitimate business opportunity. This model relies heavily on continuously bringing in new participants to sustain earnings, which is unsustainable and often unethical.

Vague Business Models: Many of these schemes claim to be involved in activities such as “Forex trading,” “AI-powered Trading,” or “Gold Mining”, yet they fail to provide any concrete evidence or transparent information about how the money is actually being generated or where it is being invested. This lack of clarity makes it difficult to verify the legitimacy of their operations or understand the true source of their revenue.

My Question to the House

Why do we continue to fall for these things time and time again? Is it possible that the widespread hunger and desperation throughout the land have clouded our ability to see things clearly and make sound judgments, or is it simply that we are a nation comprised of people who are irresistibly drawn to the idea of receiving “free money”?

Have you ever found yourself in the unfortunate position of being a victim? Or perhaps you managed to “cash out” just in time before the big crash happened? We would love to hear your personal story and experiences related to this. Please feel free to share your thoughts and insights in the comments section below. #MMM #CBEX #PonziScheme #NigeriaEconomy #Sapa #Investment

Be the first to comment